I’m veering away from my usual M&A focus to do a quick piece on funding because I’ve been fielding a lot of calls from pre-c0mmercial medtech startup leaders who have hit the end of their runway after a painful and unsuccessful attempt to raise capital last year. An early exit was their plan B but many are not quite there with their technology development to see a profitable exit and need an interim plan to finance that last bit of R&D before initiating an exit via M&A.

There are others far more expert than I in the art of the capital raise but I’ve participated in several raises, know how to be creative and make the most of a shoestring budget, and have mad research skills. So I set to work and came up with some ideas for US (below) and Canadian medtech startups that need a little more gas in the tank to get them where they need to be.

I. The 2025 Funding Crisis Landscape

Let’s start with the hard truth: Medical devices have always been a hard VC sell and traditional VCs have long failed early-stage hardware devices. Consider the following:

- 5% of lifescience VC dollars flow to medical devices vs. 28% to biotech

- Median time to exit for VC-backed device startups: 11.9 years vs. 7.3 for SaaS

- Medtech requires 3-7x more capital than digital health to reach Series B ($23M vs. $6.8M avg)4

- 68% of VCs now require <5-year exit horizons vs. medtech's 11.9-year average2

New regulatory freezes, cybersecurity requirements, and massive layoffs are expected to cause significant delays that will only exacerbate these pressures as will tariff concerns as it’s reported that 42% of VCs now require "tariff-proof" supply chains for term sheets.

Why Hardware Innovation Stalls in VC Portfolios

The "3D" Crisis:

- Dollars: $1M medtech seed rounds vs. $5M biotech averages5

- Durability: 83% of device startups require 2+ pivot events vs. 22% SaaS4

- Deregulation: FDA's cybersecurity pause creates $480K avg compliance costs2

VC Math Breakdown: Expected ROI = (Exit Probability × Exit Multiple) / (Regulatory Delay Factor) Where:

It’s unlikely that VC money is going to be easy money anytime soon so let’s great creative.

II. Alternative Funding Models & Exit Implications

1. Non-Dilutive Grants (SBIR/STTR)

- Pro: Retain equity (critical for founder-friendly exits)

- Con: 18-24 month award cycles; milestone-driven

- Exit Impact: NIH-backed startups see 22% higher acquisition multiples

- Case Study: Cardiovascular stent startup secured $2.1M SBIR → sold to Stryker at 8x revenue

2. Corporate Venture Arms (CVCs)

- 2024 Trend: J&J, Medtronic, and Siemens Healthineers deployed $4.7B

- Exit Impact: 73% of CVC-backed startups get acquired by sponsor vs. 31% for traditional VC

- Watch For: Right of first refusal clauses

3. Revenue-Based Financing

- Model: Repay investors via % of future sales (5-10% typical)

- Exit Impact: Preserves equity but caps valuation upside (multiples drop 15-20% post-repayment)

- Tool: Calculate optimal mix using Y Combinator’s RBF simulator

4. Strategic Partnerships

- 2025 Shift: Pharma giants funding companion diagnostics (e.g., Roche’s $300M Dx fund)

- Exit Impact: Co-development deals shorten exit timelines by 34%

III. The Hidden Exit Risks

- Grant Dependency: 42% of acquirers discount valuations if >50% revenue comes from grants

- CVC Strings: Median lockup period = 18 months post-investment

- Royalty Stacking: 3+ revenue-sharing agreements = 90% risk of EBITDA-crippling obligations

IV. Action Plan: Funding → Exit Pathway

Step 1: Map current runway vs. clinical milestones

Step 2: Benchmark dilution tolerance (founders vs. investors)

Step 3: Stress-test each model against 3 exit scenarios:

Policy-Driven Changes to Alternative Funding

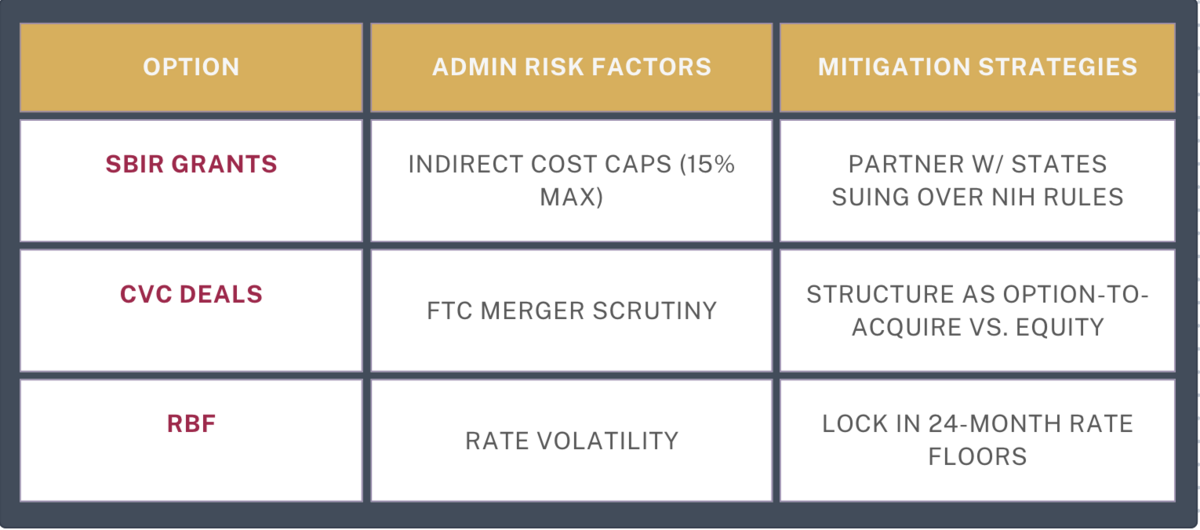

SBIR Grants in Flux

- New Risk: NIH's 15% indirect cost cap (vs. historical 30-45%) reduces institutional support6

- Opportunity: White House prioritizes "American-made surgical robotics" grants

CVC Arms: Antitrust Paradox

- FTC's merger remedy focus benefits strategic acquirers1

- But: 63% of corporate VCs now demand 2-year exclusivity windows

Revenue Financing Reset

- Fed rate cuts (projected Q3 2025) may lower RBF rates from 14% to 9-11% APR

Policy Proof Your Funding

Action Steps:

- Audit supply chains for tariff exposure using HTS codes from7

- Join AAMC's legal challenge against NIH caps6

- Leverage FDA's transitional AI validation protocols3

References Incorporated 1 FTC Antitrust Shifts (Goodwin) 2 FDA Cyber Delays (Med-Tech World) 3 AI Guidance Freeze (Akin Gump) 4 VC Drought Analysis (Deloitte) 5 Funding Challenges (MD+DI) 6 NIH Cost Caps (Arnold Porter) 7 Tariff Impacts (MedTech Dive)