“Action is the antidote to anxiety”

So says Gretchen Rubin, the happiness expert. I don't know about you, but my first instict when faced with uncertainty or crisis is to gather as much information as possible so I can make some informed choices. Easier said than done though when we are awash in a sea of information that can often be promotional, hallucinatory (are you ok, AI?), or is just plain ill-fitting for medtech or startups. Just like you, I have a business to run. I'm also a strong advocate of sharing knowledge, especially in our small startup space where gatekeeping only serves to shut out innovation and improved patient outcomes.

I create new articles or tools weekly. In order to round them all up in one central place, where they can reliably be found, I've developed a Medical Device M&A Resource Library for Early Exits. More details and a link to access can be found in the Quick Hits & Resources section below. I hope you find it useful.

Spotlight Deal of the Week

Medtronic Acquires CathX Medical for $75M

In a recently announced deal, Medtronic has acquired CathX Medical, a catheter-based technology startup, for $75 million. CathX, with limited commercial sales but promising IP, caught Medtronic’s eye as part of its strategic push into next-gen vascular therapies.

Why it matters: Deals under $100M like this show how larger strategics aren’t just chasing blockbuster buys — they’re also actively seeking innovative hardware startups with solid IP portfolios, even if those companies are still pre-commercial.

Strategy Corner

Raise Capital or Exit? Knowing Which Path to Choose

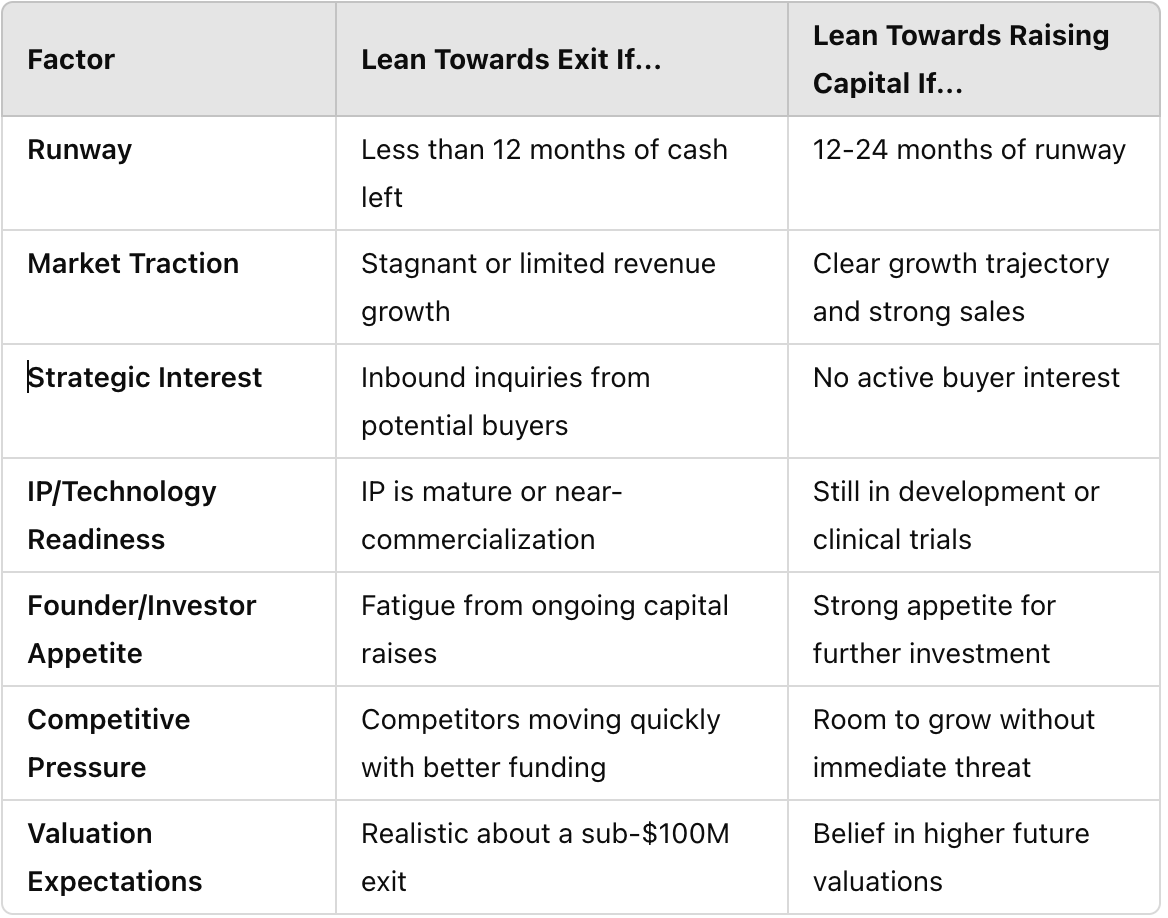

It’s a tough call many medtech founders face: push for another funding round or start prepping for an exit. I've written about this previously (look for articles in the resource library linked below) and put together a decision matrix because this is such a prevalent issue, but for now, here’s a quick way to frame your decision:

- Raise Capital If: You have explicit signals of industry confidence, are nearing a valuation changing milestone, and/or have a leadership team with strong, proven commercialization success under their collective belt.

- Consider Exiting If: You’re struggling to gain market traction, facing a dwindling runway, seeing strategic interest from larger companies, are at risk of being overtaken by competitors in time to market or acquisition.

Pro tip: If you lean toward raising capital, don’t neglect exit planning. Building relationships with potential acquirers before you pitch investors can increase your leverage and show VCs there’s a viable off-ramp.

Market Pulse

The Rise of Smaller Medtech Deals

According to recent industry reports, 52% of medtech M&A deals in 2024 were under $100M — a notable shift as strategics and even PE firms target smaller, innovative companies. This trend highlights an important takeaway: you don’t have to hit $500M valuations to be an attractive acquisition target.

Takeaway: Smaller exits are not "failures" — they can be strategic wins, especially if you’re pre-commercial and running low on capital. Knowing your realistic exit value helps set expectations and makes negotiations smoother.

Founder Focus

Common Founder Question: "How quickly can we sell the company?"

Most founders who have not yet experienced an exit are surprised by the length of time the whole process, and each stage along the way, takes. Obvious factors such as seller and buyer corporate size, asset portfolio, preparedness, and deal team readiness have significant impact on your timeline to exit. So do less obvious but common issues such as time of year (lulls are common in August and December, but I've spent Christmas Eve on DD calls so it's not a given), Board and deal team unity and agreement, and the need for external review (this could be regulatory, reimbursement, QA, or IP counsel).

If you are courting several buyers (as you should), you'll also most likely encounter prolonged tire kicking from one or more buyers that you must skillfully bring to a conclusion whilst you keep your other prospects engaged. Finally, if you are not committed to undertaking your exit with intention and a plan, and leave it up to luck or fate for a buyer to fall into your lap, your exit could turn into a neverending story with an unhappy ending.

All that said, if you approach your exit with a solid plan and commitment, here’s a rough breakdown of typical M&A timelines for medtech exits:

- Pre-sale prep: 3-6 months (clean up cap table, organize data room, build buyer list)

- Outreach and LOI negotiation: 2-4 months

- Due diligence: 3-6 months

- Finalizing deal and closing: 1-2 months

Reality check: Expect the entire process to take 9-18 months — longer if your internal documentation or cap table is messy. A rushed exit rarely ends in a strong valuation.

Quick Hits & Resources

1. New Resource Library

As we start to publish more articles, guides, and tools it made sense to bring them altogether into one resource library for easy access. New resources will be added regularly so be sure to check back often. Click on the image below to check it out.

2. Playbook: Find Your Ideal Buyers & Optimize Your Valuation

Full disclosure, I hate the term 'playbook' but I couldn't think of a better word for this resource that I put together. I've noticed that when I speak with those considering medical device M&A, when I ask about who they view as prospective acquirers they tend to focus on strategics directly in their vertical. That's leaving a lot of opportunity on the table so I created this actionable, handy resource to open up your world of M&A acquirer possibilites. You can find it in our new library, linked in the image above, entitled '5 Strategies to Uncover Premium Buyers & Maximize Your Medical Device M&A Valuation' or download it directly, here.

3. Tool: Exit vs. Raise Capital Decision Matrix

Use this simple matrix to guide your thinking on whether to pursue an exit or raise additional capital. You can also check out the guides in the library mentioned above for tips on capital raises vs exiting and bridging between the two.

How to Use It:

- Mostly Exit indicators? Focus on prepping your data room and building a buyer list.

- Mostly Raise indicators? Prepare your pitch deck but still nurture strategic relationships — exits can come unexpectedly.

- Mixed? Consider a dual-track approach: raising capital while keeping an eye on exit opportunities.

That’s a wrap for this week’s Small Ball. Remember, early exits aren't about "giving up" — they're about playing smart. See you next week!

AEC

Amanda Cooper, Founder

P.S. Have a question about your medtech exit strategy? Hit 'Reply' — I read every email.