Medtech startup founders and their investors lock horns on a range of issues, but none more than the subject of an early exit. Founders, more often than not, will say “We’re not there yet” whereas investors are much more likely to ask “How soon can we get started”.

This happens despite well thought out business plans with milestones meant to trigger such events because, as my Nana used to say, ‘Man makes plans and God laughs’. Development programs hit roadblocks, capital raises fail, runways run out and shareholder skirmishes escalate. Conversely, market appetite for your technology can surge, a KOL or media piece might spotlight your innovation, or a timely industry partnership or consolidation might present opportunity.

Whether you’re the founder intent on realizing your full vision for your device or the investor keen to reap your ROI, your best interests are served by agreeing upon a develop+commercialize (or not)+divest timeline, loosely held and subject to a quarterly review using a SWOT analysis. Incorporating this review into your quarterly reports or when you’re first contemplating an early exit via M&A for your medtech startup or SMB will help mitigate the risk of missing your off ramp. Capitalizing on market trends and opportunities and maximizing ROI while you still hold a unique, competitive edge is the goal. Here’s what the review should include:

General Factors Affecting Timing

- Technology Readiness: Exits for FDA Class I or II devices often occur when the technology has reached a proof of concept stage or later. Even without regulatory approval, demonstrating a working prototype and compelling efficacy can attract potential acquirers.

- Market Dynamics: Understanding industry consolidation patterns, reimbursement changes, and the priorities and pain points of potential acquirers will enable you to nail favourable exit opportunities.

- Strategic Buyer Interest: Some acquirers may be interested in early-stage technologies to complement their existing portfolio or enter new markets. Your timing should consider when strategic buyers are actively looking for acquisitions in your specific niche.

- Financial Performance/TAM: Profitability or revenue is often modest (or non-existent in the case of pre-commercial devices) in medtech startups but demonstrating high growth potential, a booming total available market (TAM), and reasonable COGS will lead to better valuations.

- Regulatory Milestones: Achieving key regulatory approvals can significantly increase a target’s attractiveness to potential acquirers but even without full clearance, positive progress and a clear regulatory path can suffice if the device is QMS compliant.

- Patent Strategy: A strong IP portfolio can be attractive to buyers even in pre-commercial stages and should be your key priority as that is, in essence, what you’re selling. Your timing should take into account when key patents are secured as well as when the IP strategy aligns with potential acquirers' needs.

- Funding Runway: Pre-commercial startups should time their exit before running out of capital. The average time-to-exit for medical device startups is 8.8 years, with a median of 8.2 years. However, pre-commercial startups may need to consider earlier exits if funding is limited.

Using a SWOT Analysis for Exit Timing Decisions

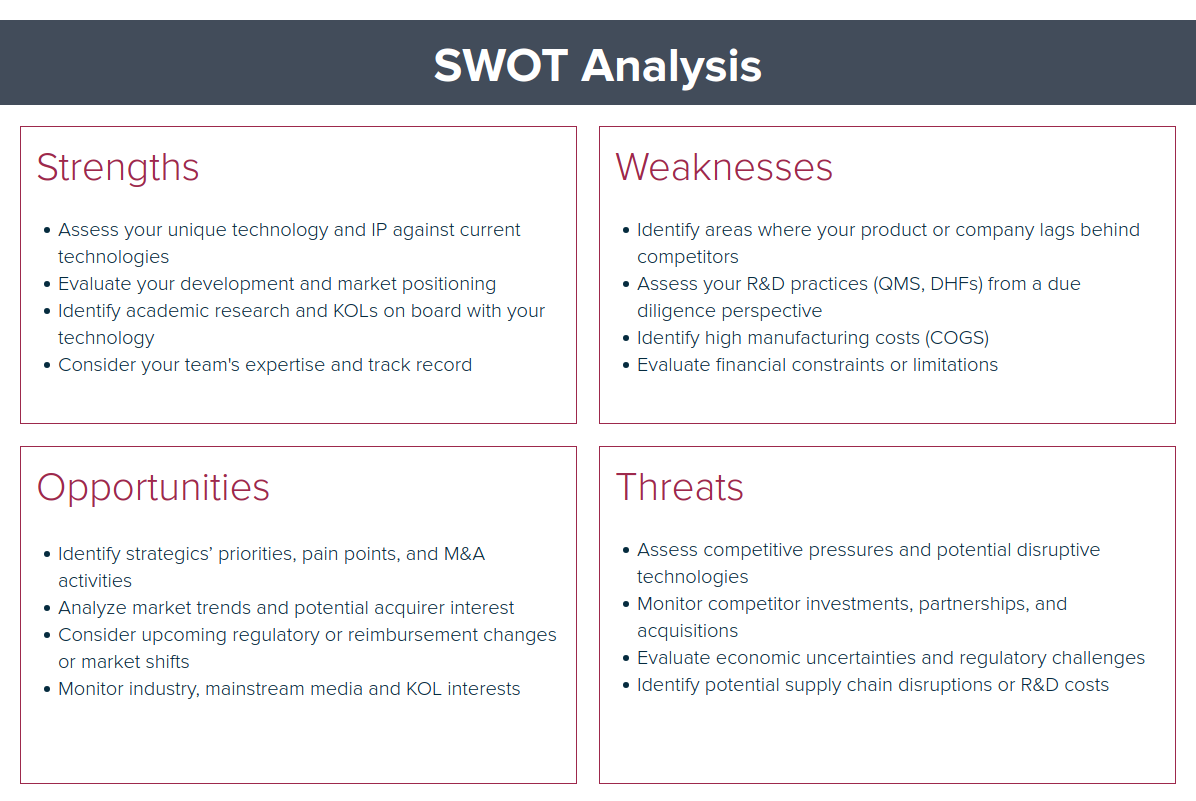

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis gives you a succinct, panoptic perspective to determine the optimal timing for your early exit. Here's what to include. I've provided it in traditional SWOT Analysis chart form as well as in text format below so that you can copy and paste for your notes.

Strengths

- Assess your unique technology and IP against current technologies

- Evaluate your development and market positioning

- Identify academic research and KOLs on board with your technology

- Consider your team's expertise and track record

Weaknesses

- Identify areas where your product or company lags behind competitors

- Assess your R&D practices (QMS, DHFs) from a due diligence perspective

- Identify high manufacturing costs (COGS)

- Evaluate financial constraints or limitations

Opportunities

- Identify strategics’ priorities, pain points, and M&A activities

- Analyze market trends and potential acquirer interest

- Consider upcoming regulatory or reimbursement changes or market shifts

- Monitor industry, mainstream media and KOL interests

Threats

- Assess competitive pressures and potential disruptive technologies

- Monitor competitor investments, partnerships, and acquisitions

- Evaluate economic uncertainties and regulatory challenges

- Monitor and identify potential supply chain disruptions or development costs

By conducting your SWOT analysis quarterly, you can identify the optimal window for your exit when your strengths and opportunities are at their peak, and weaknesses and threats are minimized.

Conclusion

A shared vision for an aligned outcome is at the heart of all strong medtech founder and investor relations. This relationship, like all others, is subject to internal pressures and external events that force reassessments and a possible change in corporate navigation. Staying regularly informed and adaptable is key to staying unified in corporate governance as well as achieving the very best exit outcome for all shareholders.